Key Takeaways

A solid exit plan will help you focus on what matters most. How do you prioritize what needs to be done and when to drive your exit strategy forward and get you to a successful exit? That’s what we’re talking about in this week’s video.

- Prioritizing the key steps to a successful exit will help you focus on one thing at a time, making it more likely that the necessary actions will actually get done!

- Top considerations in the implementation of the exit plan:

- Tax planning

- Estate planning

- Getting the right people in place

- Business continuity

Click here to watch the full video or read the full video transcript, below.

Transcript

You can have this great step by step, we’re going to do this and then we’re going to do that plan for an exit, but that could go south at any time. If something happens to you, if you die or become disabled and don’t have provisions in place, this could derail your exit plans.

A good solid exit plan will help you focus on what matters most, what’s going to have the most impact to drive your exit strategy forward and get you to a successful exit.

BUSINESS EXIT STRATEGY – Step #6: Prepare To Exit

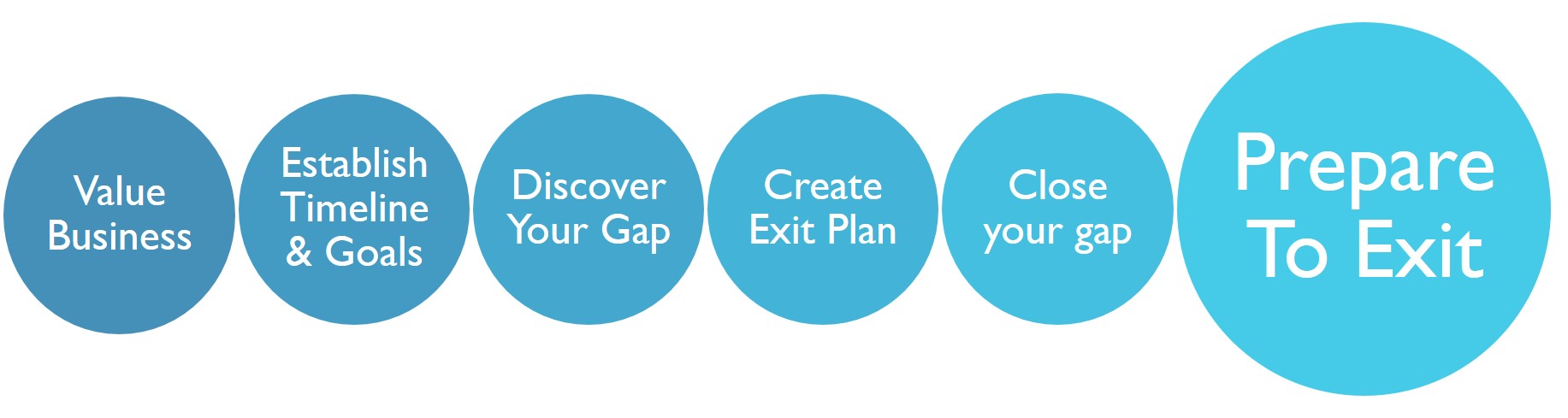

Welcome to video six, in a six-part exit strategy. This is the last step on the very high-level business exit path.

We started this video series on valuing your business, which is the first step in planning for a successful exit.

Then we established your timeline and your goals.

We discovered if there’s a gap. Is the business value worth what you need it to be worth? Do you have the personal resources to allow you to transition out of your business? If the combination of those two things isn’t going to give you the financial security that you need in retirement, then you have the gap.

We talked in last week’s video about how to go about closing that gap and overviewed what building the exit plan actually looks like.

Now we’re in the implementation phase. At this point in the process, we’ve already done a lot of the heavy lifting in growing the value of the business, preparing it for exit, and now we’re in the later stages. We know who the successor is and we’re well on that path, whether that’s a third-party sale or an inside transfer to a family member or a key employee. We’re working on those things to try to successfully make that transition happen.

NARROW YOUR FOCUS – Focus on the Right Things to Navigate a Successful Exit

I live in Oregon and one of my favorite summertime rituals when I was in my 20’s was going to the Oregon Brewers Fest. Hundreds of beers from all different breweries, all-across the country. You would go through the gates, get your beer tokens and you could get either a full beer or you can get just a little taste.

My plan was to get the booklet. I would circle all the beers like “oh I have to try this one, I have to try this one.” They had a map and it showed you where everything was and then I would map everything out because I didn’t want to be inefficient. I’m a planner, which is why I do exit planning – probably why it suits me well. But my husband said to me, he’s like “Ashley, you plan the fun out of everything!”

How does this story relate to exit planning?

I can only drink so many beers, so I have to prioritize. What are the beers that I want to try the most and in what order does it make sense to try those beers so I’m not being inefficient and going back and forth, retracing my steps or wasting my time. The same exact thing is true for exit planning.

It’s very important in the latter stages when you’re preparing for your exit, that you really focus and prioritize the things that you need to do that are going to have the most impact. And it’s the job of a good exit planner, like myself, to prioritize those things and help you.

Sometimes, when you’re so focused and you’re in your own bubble, in your own world, you can’t see what you need to do and when. Therefore, we have to prioritize, and we have to disregard all the beers that we don’t like and we’re not going to try.

It’s very hard to do that sometimes because there are a lot of good beers that you want to try. There are plenty of things that you could do to grow the value of your business or prepare for a successful exit. We can only do so much, and we only have so much time. We really have to focus in on what matters most.

A GOOD EXIT PLAN – Outlines What To Do & When

A good exit plan and doing the right things at the later stage of the game like: tax and estate planning, business continuity, identifying a successor, hiring the right people (advisor, business broker or a good solid attorney who understands how estate planning intersects with the exit of your business) are all critical things that need to be done. However, they can’t all be done at the same time, so we have to prioritize.

PREPARE TO EXIT – Tax Planning Considerations

There are certain things from a tax standpoint, that you’ll want to do sooner rather than later, especially when you’re choosing a successor and you’re planning that specific path. There are a lot of tax related decisions to make along the way. Obviously, we want to have as efficient of a tax transfer as possible.

That could be anything from changing the structure of the business and how the entity is structured from a C-corp to an S-corp or vice versa. Depending on what that succession path looks like, that might be something that you do., That needs to happen well in advance of an exit in order to be effective.

In a third-party sale, how you structure the deal – is it an asset sale, is it an equity sale… those have different tax implications.

PREPARE TO EXIT – Estate Planning Considerations

The other thing that goes hand in hand with exiting your businesses, is the estate plan. There are a lot of things you can do on the estate planning side, particularly if you’re planning to transfer your business to your children.

A good solid estate plan will help to both minimize taxes and make sure everything is set up how you would like it to be set up in order to reach your goals with leaving a legacy plan (taking care of your spouse and your children).

PREPARE TO EXIT – Protect Your Family & Business

The other thing that’s sort of related to estate planning, that happens once we have built the exit plan and we start implementing it in the later stages, is making sure that we have business continuity.

What happens if you were to die during the exit process? Let’s say you want to sell your business in two years, you’re working on getting things done, implementing the exit plan to do that successfully and let’s say you die. What happens to your business if things don’t go as planned and you pass away? Do you have Key Man life insurance?

There are things you can do as far as setting up a life insurance trust – things like that to protect the asset in the business and also protect your family – if something happens to you and things don’t go as planned.

PREPARE TO EXIT – Get The Right People In Place

If you’re planning to sell the business to an outside third party and that’s your chosen succession plan, then at this stage we really need to get either a business broker involved, some type of merger & acquisition transaction advisor or deal attorney involved to assist.

It is the job of the business broker or the M&A advisor, to market and sell your business and get top dollar. We really want to do a good job in selecting the right person to help exit the business at this stage in the game.

PREPARE TO EXIT – The Importance of Key Employees

You’re planning to sell the business to an outside third party, but you have a couple of people that need you need to stay on, until the exit and through the exit. Most third-party buyers are going to want to see a strong management team in place so that they can be assured that the business is going to continue to be successful and continue to grow and be profitable once that transition occurs.

There are things you can do like – stay bonus plans or non-qualified deferred comp plans – that will help incentivize your key people to stay. One of the areas where exit plans can go south very quickly is if key employees aren’t properly informed of the exit plans and are blindsided. They can become angry or upset, they could decide to leave, or go out and hang their shingle and compete with you.

Thanks For Reading

Thank you so much for reading. This is only part six of a seven-part series where we’re outlining the major steps that it’s going to take to exit your business.