Key Takeaways

Do you own a successful small business? Is your business highly profitable? Do you pay too much in taxes? If you said yes to all three, the cash balance plan might be right for you! You are looking at a potential 6-figure tax deduction with the cash balance plan and with that, the opportunity to put more money in to your retirement!

In today’s video, you’ll learn:

- How you can save $300,000+ for your retirement – this year alone!

- How the cash balance plan affects your Adjusted Growth Income, there’s a tremendous ripple effect that happens

- How the tax deduction works

Click here to watch the full video or read the full video transcript, below.

HOW TO GET A 6-FIGURE TAX DEDUCTION WITH A CASH BALANCE PLAN

I’m super excited about today’s video because the cash balance plans are a tremendous opportunity for you the small business owner who has a profitable and successful business, who has paid too much in taxes and wants more tax deductions. These are really beneficial if you’re close to retirement too.

If you’re over 50, and especially if you’re over 60, pay close attention to today’s video because it’s going to be highly relevant in getting you a tremendous tax deduction. We’re not talking about a $500 or a $1,000 tax deduction either. We’re talking about potentially a 6-figure tax deduction, lowering your income. It’s a powerful way to reduce your taxes and put more money into retirement for you so that when you do transition into retirement, your building up that nest egg as well.

A lot of people don’t know that these exist. A lot of CPAs and financial advisors don’t know that they exist and as a result, they’re not telling their clients about these plans. However, they have absolutely exploded in popularity in recent years. And even with all the tax changes with The Tax Cuts and Jobs Act, they’re even more compelling now!

HOW TO SAVE $300,000+ FOR RETIREMENT IN 2019

A cash balance plan is a hybrid retirement plan and it has elements of a qualified plan, similar to a defined contribution plan (401k profit sharing plans). It also has elements of a defined benefit or pension plan. It’s not a pure pension plan, but it kind of straddles the line between the two.

Since the cash balance plan is a qualified retirement plan, money that you as the business owner put in to this plan are tax deductible. That’s essentially how you’re able to make a six-figure contribution to your cash balance plan and how you can get a massive tax deduction.

What I really want to emphasize here is that the tax deduction, it’s not like a lot of tax deductions out there where you contribute to your IRA and make a $6,500 contribution and then you get tax a deduction on that amount. It’s nice but it’s not huge.

This is one of the potentially biggest tax deductions that you can take in your business. I don’t know many other places where you can find a 6-figure tax deduction opportunity in your business other than the 401k plan. They exist, but they’re few and far between.

You want to talk to your tax advisor about all this. I’m not a tax advisor, I’m not giving tax advice. I’m just trying to outline this for you so you can see the tremendous potential that this has!

CASH BALANCE PLANS – CONTRIBUTIONS REDUCE YOUR AGI TOO!

The other point I want to make about cash balance plans is, not only do you get a tax deduction on the amount that you contribute, but the amount you do contribute, lowers your AGI (Adjusted Growth Income) as well.

Let’s say you make $400,000 a year or so as a successful doctor. You’re over 60 and you can make a sizable cash balance plan contribution. What would have happened with that contribution is that it would significantly lower your AGI.

I’ve seen examples where you can go from making $400,000 a year to making $150,000 or $200,000 a year. This impacts the investment taxes you pay, Medicare taxes you pay, capital gains rates are different based on your income, and it can significantly lower your top marginal tax bracket. It can also potentially eliminate or reduce your Medicare payroll tax and help you qualify for the QBI deduction, which is something that’s new from the Tax Cuts and Jobs Act.

Again, talk to your tax advisor about this. There are certain businesses who wouldn’t otherwise qualify for that QBI deduction, but they could with a cash balance plan.

CASH BALANCE PLANS – HOW THE TAX DEDUCTION WORKS

I want to explain how the tax deduction works so that you can understand with real dollars what this looks like if you were to implement a cash balance plan.

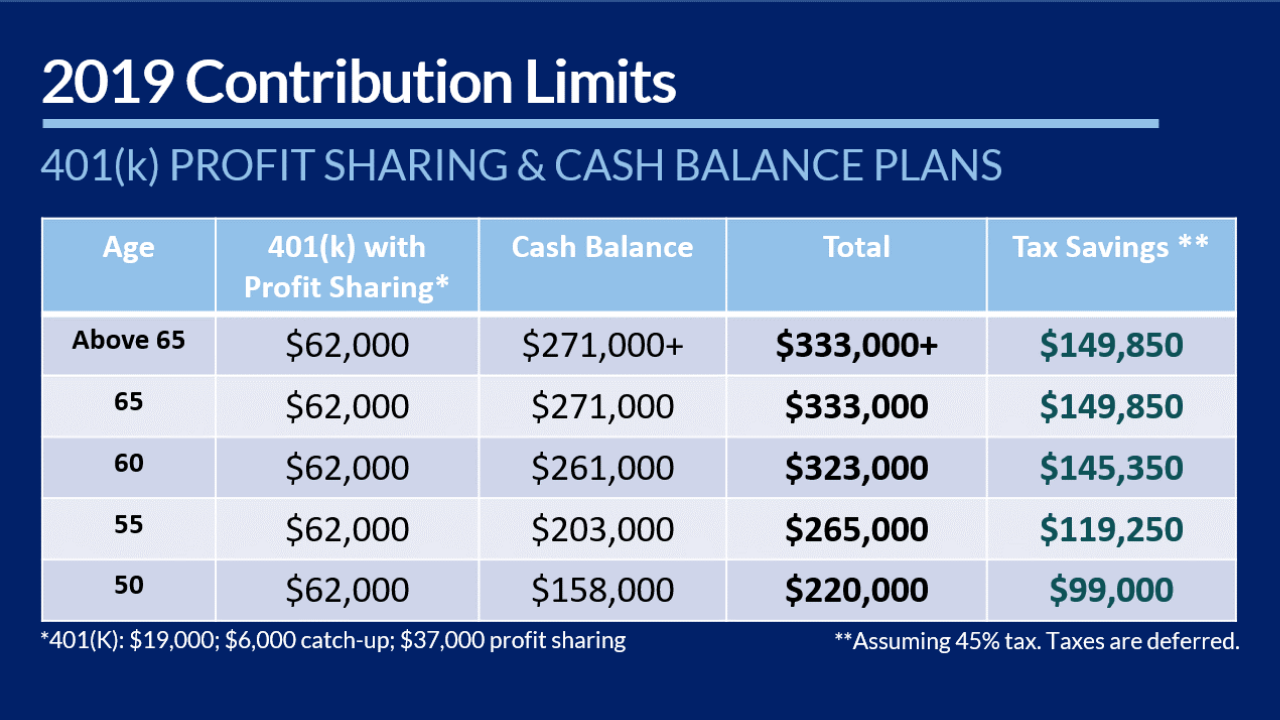

You can see on this chart that the amount that you can contribute to a cash balance plan is dictated by your age. The older you are, the closer to retirement you are, the more beneficial it is because you can put more money into the plan. At the same time, you get a higher tax deduction because the contribution amount is higher.

In the chart above, you can see the maximum contribution that you can make through the 401k plan and profit-sharing plan contribution. That’s usually where most people stop. If you’re at a point where you’re maximizing your 401k plan, you’re maximizing your profit-sharing plan, you’re like, okay, I’ve done all I can do. No, because you can bolt-on a cash balance plan. It doesn’t eliminate the 401k or the profit-sharing plan, it’s in addition.

You can see that the contribution amounts that you can make with a cash balance plan is massive. This is where we get the 6-figure tax deduction. This is just in 2019 alone! And that’s why the tax savings are so significant because it reduces your income and you get a tax deduction for every single dollar that you put into the cash balance plan in a given year.

Is a cash balance right for you?

The truth is there are five questions you need to answer in the affirmative to decide if a cash balance plan is right for you. Click on the link below to schedule a strategy call with me. It’s free, it’s simple and it takes 15 minutes. And in that 15 minutes, you will have a much clearer idea of whether or not the massive opportunity that exists with the cash balance plan is appropriate for you!