Key Takeaways

What if you could save over $200,000 extra dollars this year in 2019 and get a tax deduction for it?

Today we’re talking about what we think is the best kept secret in the retirement plan industry, the cash balance plan. These plans have absolutely exploded in popularity since about 2006 when the US government clarified the rules on these plans and with the Tax Cuts and Jobs Act, they’re even more compelling!

In today’s video, you’ll learn:

- What is a Cash Balance Plan

- How it works

- And who it’s appropriate for, so you can decide if this type of plan is right for you!

Click here to watch the full video or read the full video transcript, below.

CASH BALANCE PLANS – AN INTRODUCTION

Let’s talk about the cash balance plan. Honestly, I talk to a lot of business owner clients about the cash balance plan and most of these clients have never heard of one. Their CPA is not telling them about this. Their financial advisor they had before, wasn’t telling them about this. Nobody is talking about the cash balance plan. It’s sort of this best kept secret.

Cash balance plans have not been around for nearly as long as the 401k plan. Frankly, I think a lot of people just aren’t keeping up with them. A lot of industry professionals, who don’t want to specialize or have a background in 401k or profit-sharing plans, have absolutely no clue what these plans are. And as a result, a lot of businesses haven’t really adopted them because they just haven’t been aware of the opportunity. But the opportunity is incredible!

If you’re a successful business owner, you’re over 50, your business is profitable, you pay way too much in taxes, and you want to reduce your tax bill, this video is for you.

By the way, the number one reason why a business owner will adopt these plans is because of the significant tax benefits. I’m going to talk about that in more detail in another episode. So, come on back to that video, which is part 2 of this 4-part series.

CASH BALANCE PLANS – HERE HOW IT WORKS…

The cash balance plan allows you to sort of kill two birds with one stone. It allows you to accelerate your retirement savings way above and beyond what you could do in the 401k plan, in the profit-sharing plan. It also allows you to get a significant tax deduction for those higher savings amounts.

A cash balance plan is a hybrid retirement plan. It has elements of defined contribution plans, which are 401k profit sharing plans, and elements of pension plans or defined benefit plans. It straddles the line between the two.

The reason why this is important is because a cash balance plan is a qualified retirement plan and because it’s a qualified retirement plan, there are certain rules and restrictions with it. But if you follow the rules, you’ll receive a massive tax deduction for doing so.

Here’s how it works:

You wouldn’t implement a cash balance plan unless you already had a 401k and a profit-sharing plan. Assuming those two are in place, you’re going to add a cash balance plan, but it doesn’t replace the other plan – you add it to the mix.

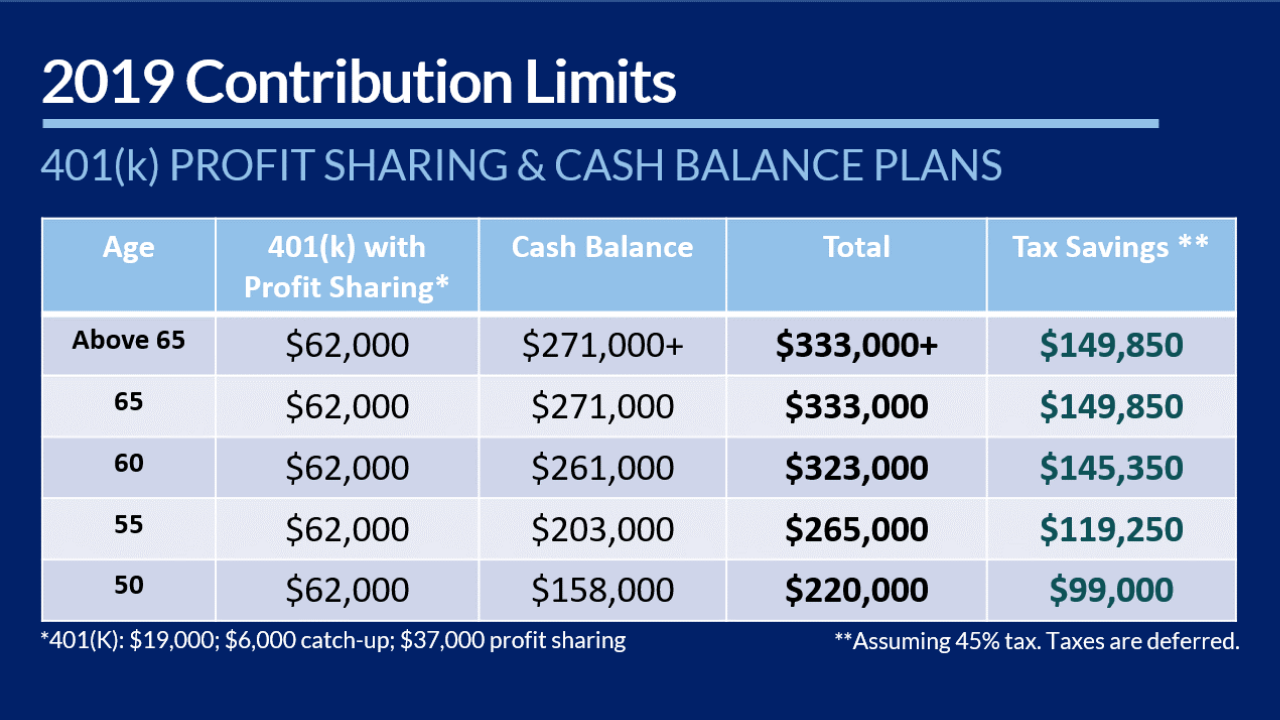

You can see on the chart above that after you maximize your 401k contributions, matching dollars and after you maximize the profit-sharing contribution, you will still want to contribute more. You want a big tax deduction. Enter the cash balance plan.

According to the chart, the contributions that you can make to the cash balance plan are based on your age. The older you are, the more you can contribute. But look at the additional amount of money that you can put in to your retirement accounts for that given year and get a tax deduction. You can see how massive those tax savings potentially are.

If you’re fully utilizing your 401k, your profit-sharing plan and your cash balance plan all in conjunction with each other and maximizing those contributions, you can get a tremendous amount of extra dollars. You could squeeze 20 or 30 years of retirement savings (if you’re behind) into 5 or 10 years when you utilize a cash balance plan and get a massive deduction.

CASH BALANCE PLANS – WHAT YOU NEED TO KNOW

A few more details regarding the cash balance plan. Because it has some elements of a defined contribution plan, there are required annual employer contributions. What this means is that you want to make sure that if you’re going to implement a cash balance plan, that you intend to maintain the it for at least several years, your business has enough cash flow, it’s profitable and it’s not highly cyclical.

I also want to mention with the cash balance plan, you do not have to do the maximum that I outlined in the chart above. You don’t have to maximize the contribution every year. The amount that you can contribute, can and will vary.

The other thing that’s really cool about the cash balance plan is that these plans are portable. If you’re the business owner and you retire, you’re not having to take an annual income or monthly income stream. You’re not stuck with that. You can roll the money over into your IRA account and then you can do whatever you want with it at that point.

The last thing I want to mention about the cash balance plan is that there are certain requirements for how these accounts are invested. They tend to be more conservative and an ideal target rate of return is somewhere in the 3% – 6% range. It allows us diversification because you might have these other investments in the stock market and you’re trying to maximize the growth on that. But the goal with the cash balance plan is to hit a targeted rate of return every year, which is in the mid-single digits.

Do You Have Questions About The Cash Balance Plan?

Maybe this is all new to you, you’ve never heard of it before and you’re asking yourself “is this right for me?” We can discuss the cash balance plan, I’ll ask you some questions and see if this is a good fit!