Key Takeaways

Do You Know?

- Who your successor is?

- When you’re going to exit?

- What your business is worth?

- How you’re going to go about minimizing your taxes?

- What you need to do and the steps you need to take to exit your business successfully?

That’s what a good, solid exit plan will do for you. It will outline the major pieces of the puzzle. More importantly, it will help you prioritize what you need to do and when, to navigate the exit from your business.

That’s what we’re talking about today – how to go about creating and implementing an exit plan for your business and your transition into retirement.

This is part 4 in a 7-part series on exiting your business successfully!

Click here to watch the full video or read the full video transcript, below.

Transcript

Business Exit Strategy 4: How To Create Your Business Exit Plan

My name is Ashley. I’m the CEO of True North Retirement Advisors, where we specialize in retirement and exit planning for business owners. We do wealth and investment management, financial planning, 401K and retirement plan consulting, and exit planning.

Today the focus of the video is on the exit planning piece. This is my favorite part of the exit planning process.

This is video four in a seven-part series where I’m outlining the major steps that you will want to take in navigating the exit from your business.

Why I love this piece so much is, because it really lays the foundation for everything else that we do from this point forward. This is where it gets customized, we identify who the successor is.

Once we do that, there are several things that would happen for a family transition, or a key employee transition, or a third-party transition, that wouldn’t happen in those other scenarios.

After we identify who the successor is and some of the other key elements of the exit plan, we can really start to take action and implement the things that need to be done to protect the business and successfully transition the business to that next owner.

Shift Your Mindset – Work “On” Your Business, Not Just “In” Your Business

I think one of the biggest issues for business owners in navigating a successful exit is that they really don’t understand how to go about doing that. As a business owner/ entrepreneur, for most of your career you’ve got your head down. You’re working in your business.

This really requires you to take a step back, put your head up, and look on out to the horizon and say, “Okay. How do I work on my business?” That’s what a good exit plan does, is it allows you to really start to work on your business instead of just in your business.

Map Out Your Exit – Then Take Action

One of the things that I notice, and I’m guilty of this as well, is that business owners are very action oriented. You see what you want. You see where you want to go, and you immediately start taking steps to go after that and go get that. That’s part of the reason why many entrepreneurs who are successful, are successful because so many of us, we see what we want, we have the same dreams, the same goals, but the difference is the action. A successful entrepreneur or business owner actually takes action.

I think being action oriented can also come back to bite us when it comes to exit planning because we really first have to do a very strong inventory, put the plan together, figure out all those major decisions, how we’re going to minimize taxes, how we’re going to protect the business as we transition, before we jump to the solution.

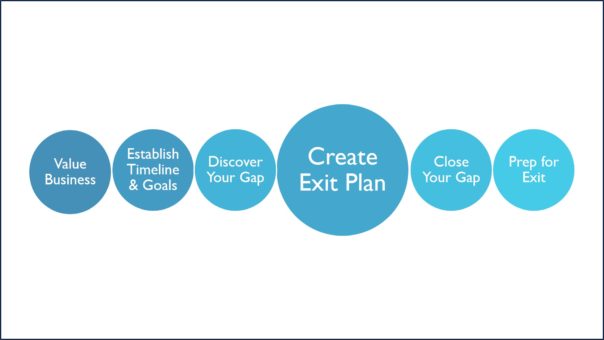

This is part four of the video series. In the first three parts, we looked at valuing your business, establishing your timeline for your exit and your goals, and then discovering your gap, which was the last video that I did on this topic.

You can see that the exit plan and the creation of the exit plan doesn’t happen until now. We start taking those steps and prioritizing to put those action items in place so that we can bite off the elephant one bite at a time and gradually move closer and closer to a successful exit.

When To Create An Exit Plan – 5-10 Years From Target Exit Date… Seriously!

If you’re doing this right, this can take five years. It can take 10 years. In most cases, you’ll want to start the exit planning process with enough lead time, enough of a runway, that you can start to put some of these things into practice.

I was just reading over the weekend how a lot of times it might make sense if you were a C corp before for tax purposes, for exit planning purposes sometimes it makes sense to change your business structure and move to an S corp. We can’t just do that overnight and then exit your business the next day.

Some of these steps are quick and easy. Some of them take more time. Some of them other people, like your attorney or your CPA, would need to get involved in terms of – in the example of changing your business structure. There are so many things that you can do once you have your exit plan in place.

Create Your Exit Plan – Be flexible and make changes as needed.

The other thing I want to emphasize about the exit plan is, it’s not like Moses comes down with the stone tablets and says, “This is the plan. This is what we’re doing. This is done.” No. It’s not like this is set in stone Ten Commandments style plan. It’s flexible and it can change like all good plans should.

Just like if you’re going on vacation, you want to be flexible and open because if something goes wrong or if something changes, which it inevitably does, it’s important to be able to pivot and move and be flexible to that.

Your Business Valuation – The first step in your successful exit strategy.

If you’ve watched some of the previous videos, I’ve sort of beaten you over the head with this now. The very first step in a successful exit is understanding what your business is worth. We need to do that as the first step.

What I want you to do is go to truenorthra.com/valuemybusiness. There, you will get a free checklist and unlimited access to our valuation tool. The checklist is going to provide you the eight pieces of information you need to plug in to the valuation tool to figure out what your business is worth.

Before you lay your head down on your pillow tonight, you can figure out what your business is worth. That is the first step, because before we ever get to drafting the exit plan, we need to know what your business is worth!

Thanks For Reading

Thank you so much for reading. This is only part four of a seven-part series where we’re outlining the major steps that it’s going to take to exit your business.