Key Takeaways

For a lot of people, what they have today is not what they need when they retire. So there’s a gap. There are a lot of ways to close that gap, either through pulling levers in the business or pulling levers on the personal side, and that’s what we’re talking about today.

This is video 5 in a series of 7, where I lay out the process of establishing your exit plan, so you can successfully exit your business.

We will look at:

- How you can prioritize the important work that needs to be done to successfully exit your business.

- Steps you can take on the personal and business side, to “close your gap.”

- 3 concrete ways you can start closing your gap.

Click here to watch the full video or read the full video transcript, below.

Transcript

Business Exit Strategy 5: Close Your Gap

In the first few videos, we talked about valuing your business, discovering your timeline and your goals, discovering your gap, creating the exit plan, and today we’re focusing on closing that gap. So, what do I mean by closing the gap?

Well, it’s simple. In the early stages of the exit planning process, it’s really, important to figure out what the business is worth and what your personal financial resources are. Is the combination of those two things, going to be enough to sustain you in retirement so you don’t run out of money?

IMPORTANT, NOT URGENT – TAKE SMALL STEPS TOWARDS YOUR EXIT PLAN

If you’ve ever heard, I forget who invented it, but there’s the four quadrants of to-dos. Where exit planning falls typically in the important, but not urgent. Those are always the tasks that get pushed to the bottom. Those are always the running to-do lists. I should do this. I should do this. I should do this.

But because it’s not urgent, or at least it may not be urgent until it’s too late, we sometimes wait. That’s why a lot of exit plans fail, or people who don’t do an exit plan fail to exit their business successfully. That lower quadrant of not urgent but important, always stays there.

We really need to work towards elevating some of the exit planning process to important and urgent. How we do that is by tackling it one little bit at a time.

YOUR EXIT PLAN – WHERE THE REAL WORK BEGINS

Now that the exit plan is created, we can start getting to work. The plan is the road map. It tells us where we’re going to go, what we’re going to do, and what steps we’re going to take to successfully exit your business. The plan dictates what the action items are that you actually do in the implementation of the exit plan.

This is the fun part because this is where the real work begins. I think a lot of people make a couple of mistakes in this area. One is, they want to get to work right away. They know that they’re not where they want to be. Without stepping back and taking that 30,000 foot view, and really understanding what it is that they should do, what it is that’s going have the most impact, they just hit the ground running and they get to work right away.

Really when it comes to exiting your business, especially when it comes to closing that gap, we want to focus on the right things. These are the things that are going have the most impact to close the gap, getting from where you are today to where you need to be.

CLOSE YOUR GAP – DIVERSIFY YOUR CUSTOMER BASE

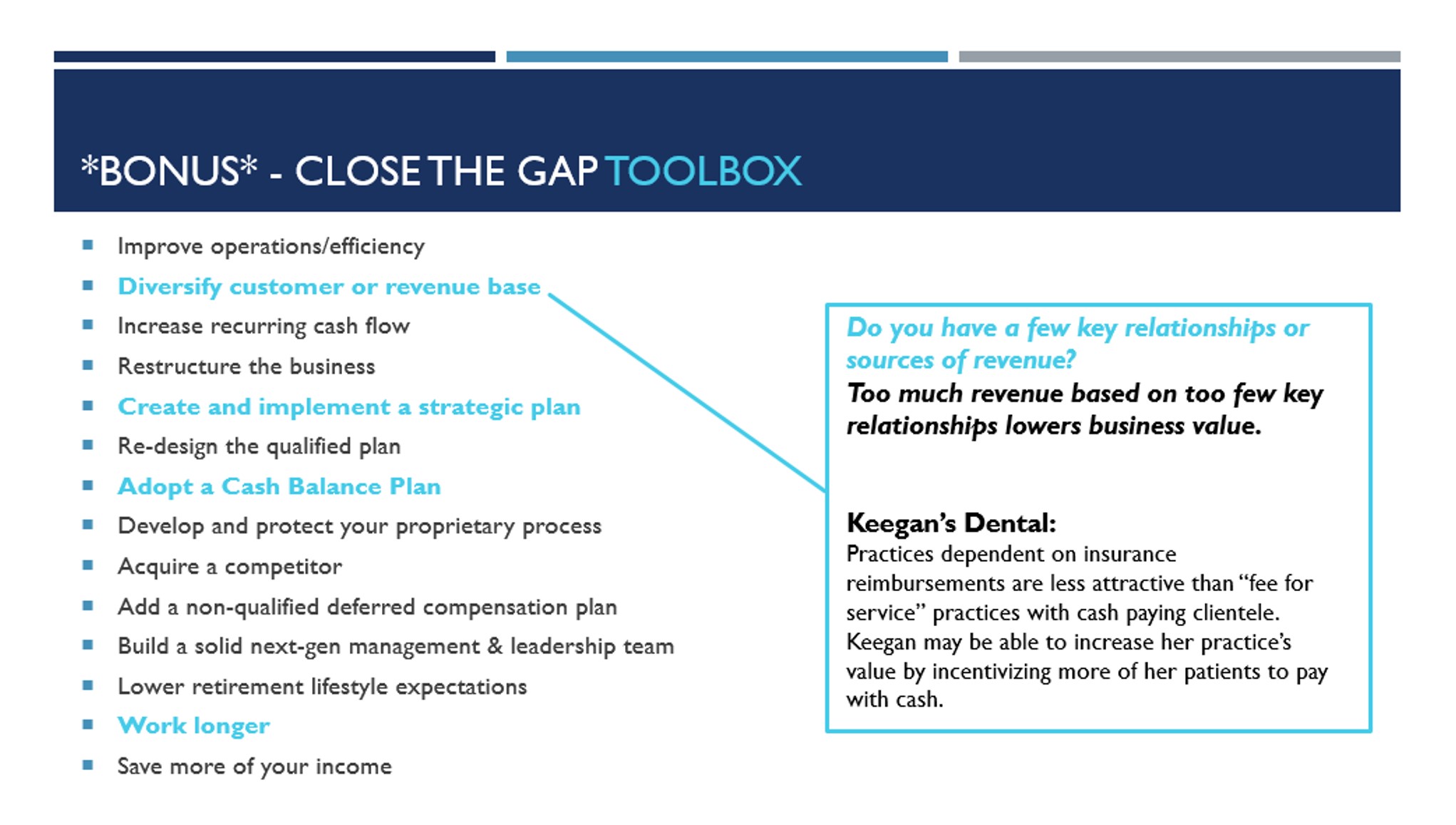

When we talk about closing the gap, what are some specific things that you can do to close that gap? What you’re going see in the picture above, is a list. These are some common ways both in the business and on the personal side where you can close your gap.

I just want to focus on two of those levers, one of the business side and one on the personal side. The example that I highlighted here on this slide that you’re seeing is diversifying your customer or revenue base. This is a key value driver that can really help increase the value of your business.

A lot of businesses have some key customer client relationships. I was talking to someone yesterday who wants to start the process of exiting her business. She has two very well-known clients, big brands, like household name brands. Those are her two biggest clients and they make up the vast majority of her revenue. That’s a problem. And I think most of you understand why. If one of those client relationships falls by the wayside suddenly, her business could go under or she’s really going to have to rethink things. So, it’s better to diversify your customer base now while you still maintain those relationships.

CLOSE YOUR GAP – DIVERSIFY YOUR REVENUE BASE

One of the examples, that I’ve been talking about throughout this video series is, a dental practice. In the early stages of these videos we did an evaluation for a dental practice and I showed you what that looked like. It’s called Keegan’s Family Dental.

Something that Keegan can do, that’s related to this value driver and increasing the value of her business is, changing her dependency on insurance reimbursements. Insurance reimbursements, when it comes to dental practices, are much less attractive than fee-for-service practices where you have cash paying clientele.

Keegan has plenty of patients, she’s not needing to diversify her customer base. But, she does need to diversify her revenue stream and figure out ways that she can incentivize more of her patients to pay with cash.

Now for some of these things, you may have to hire an outside business consultant who can help you implement some of these value drivers for your business. But if Keegan can really get away from relying mostly on insurance reimbursements and move to cash paying clientele, then that’s going to grow the value of her business.

CLOSE YOUR GAP – ADOPT A CASH BALANCE PLAN

One of the other tools, in the close your gap tool box that I wanted to highlight that’s related to both the business and the personal side, is a balance plan. You’ll see the cash balance plan down in the middle of the page (toolbox illustration above).

A lot of people don’t really know what a cash balance plan is, but it is a powerful tool. If you are about five to 10 years from retirement, the business is profitable and there’s lots of cash flow – you can actually sock away a couple hundred thousand dollars or more every single year inside a cash balance plan. It’s a huge tax deduction for the business and it allows you to really accelerate what you’re saving.

I’ve seen illustrations of plans where you can save, between the 401(k), the profit-sharing plan, and the cash balance plan, you can get like $300,000 into your tax deferred retirement accounts in a given year. It’s very powerful!

VALUE YOUR BUSINESS – TAKE THE 1ST STEP TO A SUCCESSFUL EXIT

Exit planning can go in a lot of different directions. Once you craft the plan, then we can get to work. The amount of work and what we do and the different things that we might do as part of the exit plan is all determined on what that exit path looks like and how big your gap is.

I would encourage you, if you haven’t yet watched the other videos in this series, to do so and get a feel for this process. I encourage you to value your business. That is the first step on a successful exit plan journey because you need to know what you’re dealing with today. Take stock. What is your business worth today? Is it worth what you need it to be? Then we can establish the timeline, goals, and move forward from there.

If you go to >>>truenorthra.com/valuemybusiness<< I have a free software tool where you can value your business on your own. At True North, we can also help you with that process as well. You’ll get a free checklist of the eight critical pieces of information that you need to value your business, plus free lifetime access to the valuation tool. You can get a value for your business and then you can go back in a month, two months, five months, five years, and revalue your business as you implement some of these value drivers and as the business of value changes.

Thanks For Reading

Thank you so much for reading. This is only part five of a seven-part series where we’re outlining the major steps that it’s going to take to exit your business.