Key Takeaways

HSA contributions are going up in 2020, which makes this the perfect time to take a closer look at the HSA (health savings account) and all of its great benefits. You get tax deductible contributions, tax-free growth and tax-free withdrawals. No other retirement account can match the tax benefits of the HSA!

In today’s video, Ashley’s doing a deep dive on the HSA. If you’re not contributing to one, hopefully by the end of this video, you will be convinced that it is an essential component of a successful and well thought out retirement plan for you.

You’ll learn:

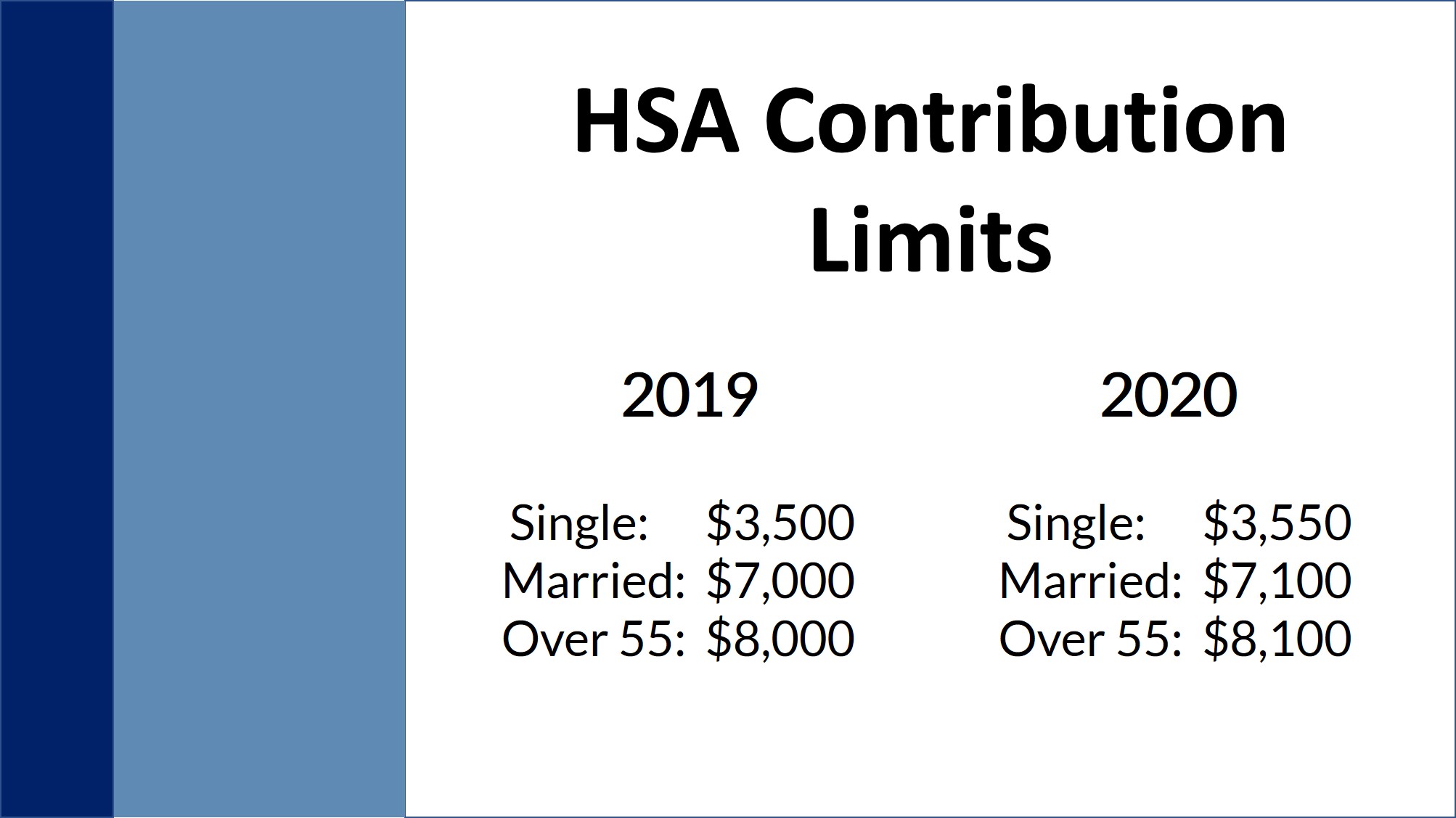

- What the new HSA contribution limits will be for 2020. Good news, they are going up!

- The benefits of an HSA as it relates to retirement planning and the mistake you might be making with your HSA. You’re not alone, most of us are doing this.

- What your savings account priorities should be when it comes to planning for retirement and why it’s important to get started on your HSA now!

Click here to watch the full video or read the full video transcript, below.

Transcript

HSAs – The Holy Grail of Retirement Savings Accounts

Today, I’m talking about the HSA, otherwise known as the health savings account. This account is the holy grail of retirement savings accounts. No other account matches it in terms of its tax treatment.

You’re allowed to sock away a pretty good chunk in your HSA every year and that’s going up next year in 2020. The chart above shows the current contribution limits and what they will be for 2020.

In terms of retirement accounts, I really would like you to consider the HSA. I know this is totally backwards and counter to what most people do, but the HSA, because of its tax benefit, is amazing! The 401k, the Roth – none of it can match what the tax benefits are as saving money in your HSA.

If you are eligible, I want you to think about trying try max out your HSA before you max out your Roth or your 401k. The tax benefits are so beneficial and you’re going to need this money to pay for your health care costs in retirement. You probably won’t ever be able to contribute enough to cover what you’re going to have to outlay for your medical costs in retirement, with rare exception.

The Mistake You’re Making With Your HSA

I want to talk about the big mistake that most of you are making with your HSA. You are thinking about your HSA in terms of paying for current health care expenses. You might be contributing to an HSA account right now and that’s great! However, you might be using most or all those dollars every year or not contributing up to the limit every year and viewing this as a long-term retirement savings vehicle.

I want you to think about the HSA as a long-term vehicle because what you can do with an HSA, that most people don’t realize, is that you can invest those funds. It does not have to sit in cash. It does not have to be used in the current year, you can invest that money.

It would be wise for you to invest that for growth for a retirement account, just like you would your 401k, your Roth or any other retirement account that you have earmarked for retirement. Again, you get tax free growth while that money is in the HSA. Then, when you pull it out of the health savings account in retirement and pay for medical expenses with it, it’s a tax-free withdrawal. It’s an amazing benefit of the HSA and it saddens me that more people don’t take advantage of it as a long-term vehicle.

To put some real numbers around this, if you are retired today, the average cost for an American’s healthcare expenses is about $1,000 a month, that’s $12,000 a year. If you look at it over your lifetime, most Americans are going to spend in the range of $280,000 in retirement, specifically for healthcare expenses. We all know that healthcare is going to be costly in retirement, it’s a big conundrum and paying for health care costs in retirement and health savings account is a way that you can front load those expenses.

While you’re still working, while your income is still high, while you don’t have the burden of paying for these medical costs in retirement, you can sock money away in an HSA. You can save it for later when you are retired, and in the meantime, it can grow for you.

Thinking about long term care needs, if you get dementia, Alzheimer’s or spend time in an assisted living, it’s very expensive. Your cost for healthcare and retirement skyrocket if you’re in that boat.

Health Care In Retirement – How to Pay In A Tax Efficient Way

If you change your mindset around the HSA and stop thinking about it as a way to pay for current medical costs, and instead, a way to pay for future medical costs, that alone is going to help quite a bit just in terms of how you invest and what you do with those HSA dollars.

What I really want to emphasize here, is that this is going to be the most beneficial for people who are 5-10 years out from retirement and even further out than that. Because the more time you save money in the HSA, invest that money, let that grow, the more you’re going to be able to accumulate in that account to pay for health care costs in retirement.

Don’t delay, start now! You can do research online and see if you meet the eligibility requirements. Primarily you have to be in a high deductible, health care medical plan in order to qualify and save in an HSA. Make sure you are able to contribute to an HSA and give it that priority in your retirement savings account.

When it comes to saving and prioritizing, I want you to think of an HSA first, then a 401k/Roth IRA/other retirement accounts, and then if you still have money leftover and you’re saving, then you can start thinking about putting money in taxable accounts. Your HSA is a powerful tool for paying for the inevitable high costs of medical expenses that you will have in retirement.

Do you have questions about an HSA plan and whether it’s right for your situation?

You might have questions about:

- Whether or not an HSA makes sense for you.

- How to set up an HSA.

- Whether or not you’re eligible for an HSA.

- How you should balance the savings in an HSA with all the other competing financial priorities and all the other accounts that you’re trying to save for retirement.

If you have questions about your unique situation and you’d like to schedule a call, it’s free, there’s no sales pitch, you’ll talk to me. I can answer all the questions that you have about an HSA.