Clients ask me all the time: “Ashley, when’s the best time to take my RMD, at the beginning of the year or the end of the year?”

That’s a really good question! Today we’re going to look at 3 different options for taking your RMDs.

You can take your RMD:

- At the beginning of the year.

- The end of the year.

- Or, you can take as a monthly income stream throughout the year.

The truth is, it does matter when you take your RMD!

RMD Basics

When you turn 70 ½, you must start taking RMDs from your Traditional IRA or 401k, with few exceptions. The RMD amount is calculated based on the previous year’s ending value. Whether you take your RMD in January or December of the following year, that amount is determined ahead of time. It won’t change, even if your account balance fluctuates wildly during the year.

Since you have options about when you take your RMD and it DOES matter when you take your RMD, it’s important to be strategic about that decision. Let’s jump in to the pros and cons of 3 common timing strategies.

Option 1 – Take your RMD at the beginning of the year

Many IRA investors will take their RMD at the beginning of the year. I don’t like this strategy, and here’s why:

According to the IMCA Retirement Corporation, the stock market has posted positive results for the year 74% of the time going back to 1926. If you’re a more conservative investor, with most of your IRA in bonds, history shows that it’s even more likely that you’ll post a positive return in any given year. Since 1980, the Barclay’s Aggregate Bond Index has only posted 3 down years. In other words, the bond market was positive about 92% of the time over the last 37 years.

While no one can predict the future, the likelihood is, in most years, that a diversified portfolio will be positive in any given year. Not only that, but if you take a look at this chart, it shows you that it’s also very likely to see double-digit returns in the market in any given year.

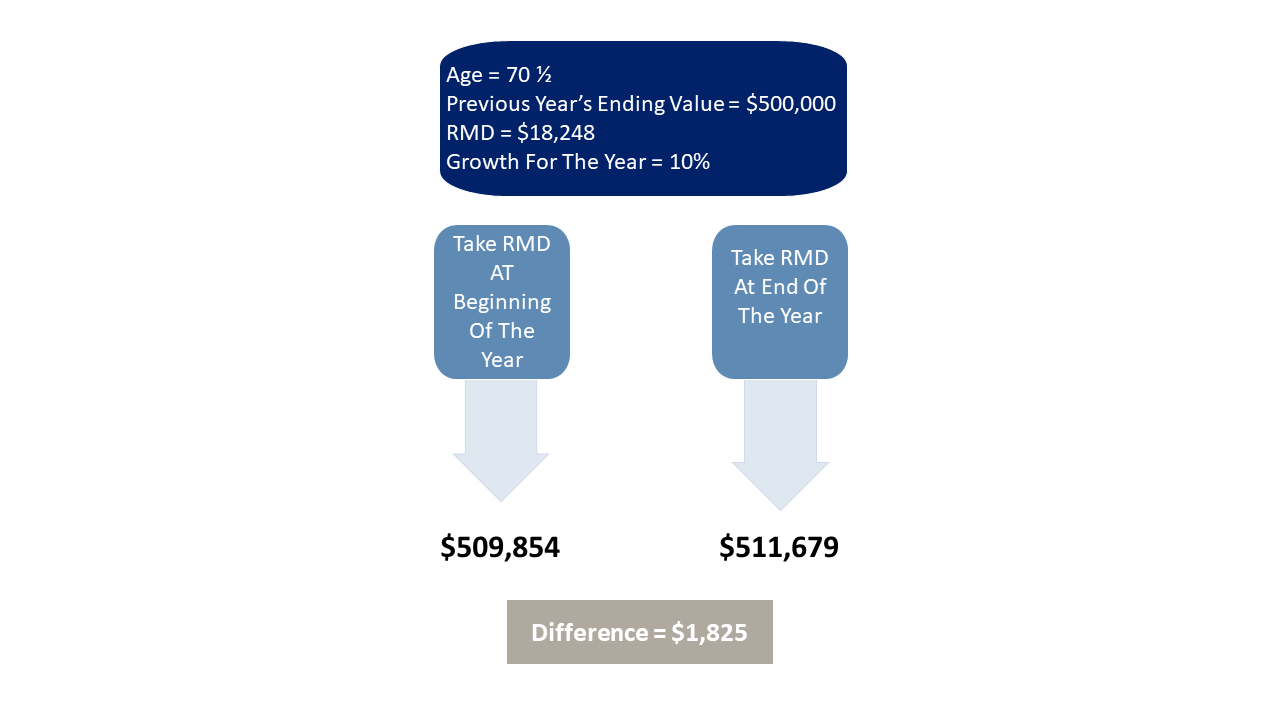

Knowing that the stock market is more likely to be positive the VAST MAJORITY of the time, let’s look at an example that shows why it can be harmful to take your RMD at the beginning of the year.

If you took your RMD at the beginning of the year, it cost you $1,825 in this scenario!!

Calculate the difference for yourself here >>> Calculate Future Value

Option 2 – Take Your RMD at the end of the year

For reasons explained above, I tend to prefer this scenario. Take your RMD distribution at the beginning of the year.

Just don’t wait until the last minute to take out your RMD. If it were me, I would take my RMD in October or November. If December is a banner month, you could miss out on some gains. However, you’ve been invested for long enough in the year to hopefully realize most of the benefits of staying invested.

Option 3 – Take your RMD monthly

A really common strategy that a lot our clients utilize is taking their RMD monthly. This has a couple of benefits:

- By taking your RMD out monthly, you can smooth out the monthly ups and downs of your account and reduce the impact of a poorly timed lump sum distribution.

- You stay invested for longer during the year.

- You reduce the temptation to try to time the market. I mean, come on, who can really predict how your portfolio and the markets and the economy will really perform in any given year. So just let it go and take out your distribution every month.

Option 4 – Don’t take your RMD at all

That’s not an actual option, is it!?

Yea, you’re right…but let me explain what I mean!

You still have to take your RMD out of your IRA for the year – there’s no getting around that! However, if you donate it to charity, you won’t have to report it as income for the year! And by keeping your income lower, you can potentially lower your taxes. Happy dance!

I made an entire video explaining how donating your RMDs directly to charity can lower your tax…