There are many benefits to making charitable contributions directly from your IRA. If you are subject to RMDs, you’re donating to charity, and you haven’t considered charitable contributions directly from your IRA – you could be paying more in taxes than you need to!

Many investors look at the difference in making charitable contributions from their IRAs vs. regular donations to charity (i.e. writing a check) as a “six of one, half a dozen of the other” issue.

But that assumption is wrong! Every dollar you withdraw from your IRA is included in your adjusted gross income for the year.

One way to avoid reporting higher income and potentially higher taxes is to send your RMDs directly to charity.

What are Qualified Charitable Distributions (QCDs)?

According to the IRS, a Qualified Charitable Distribution (QCD) “is an otherwise taxable distribution from an IRA (other than an ongoing SEP or SIMPLE IRA) owned by an individual who is age 70½ or over, that is paid directly from the IRA to a qualified charity.”

When you set this up correctly, you will be able to keep those RMDs out of your taxable income for the year and you won’t be taxed on those distributions either – it’s a pretty genius strategy.

Yet, we find that many IRA account owners who are subject to RMDs aren’t taking advantage of this powerful tax strategy.

Why aren’t more people taking advantage of QCDs?

I think it’s because there is a lack of knowledge of the strategy and its benefits among a lot of different types of investors:

- DIY investors who may not know about this more advanced strategy and the tax implications involved

- Investors who don’t discuss their charitable giving with their tax or financial advisor

- Investors who work with tax and financial advisors who aren’t proactive with their clients

All are all missing out on the potential tax savings of this powerful strategy.

The Most Important Benefit of the QCD

Here is the most important point of this entire blog post: Every dollar that comes out of your IRA and goes directly to charity in the form of a QCD, is excluded from your adjusted gross income (AGI).

Lowering your AGI can have a tremendous ripple effect on your tax situation, and impact the following:

- Tax credits

- Deductions

- Exemptions

- Phase-outs

- Social security taxes

- Medicare surtax and premiums

Making QCDs, instead of donating directly to a charity, is a great way to try to minimize your income.

QCDs – Know the Rules

Before we jump in to the case study below, I want to clarify a few technical pieces of this rule:

- You must be 70 ½ to take advantage of Qualified Charitable Distributions.

- You cannot make QCDs from 401k accounts, SEP IRAs, or SIMPLE IRAs. If you’re interested in this strategy, you may want to consider rolling these other retirement accounts into a Traditional IRA account.

- The annual limit on QCDs is $100,000/person.

- The QCD must come directly from your IRA. You cannot take an IRA distribution and then make a charitable contribution.

- To demonstrate proof of your charitable contribution, you should keep an acknowledgment letter from the charity, just like you would keep records of any other charitable contributions.

QCD saves $3,652 in taxes – A Case Study

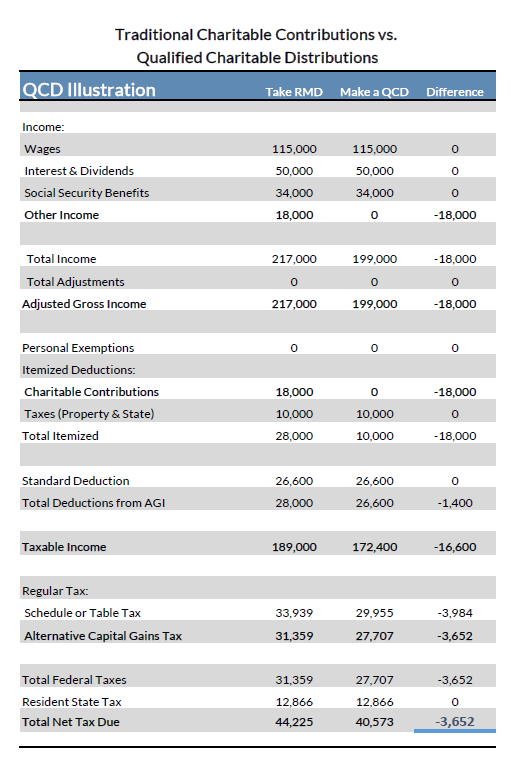

To really illustrate what this strategy looks like in the real world, let’s look at a case study of 2 scenarios:

- Donating to charity the old-fashioned way (i.e. writing a check from your bank account)

- Making a QCD (i.e. making a charitable contribution directly from your IRA)

We’ll look at the tax implications of each scenario, so you can see how it really does matter where those contributions to charity come from.

Case Study Assumptions:

-

- 72-year-old married couple

- 1 spouse is retired. Other spouse is still involved & working in a family business

- Income:

- Wages = $115,000 (from family business)

- Dividend & Interest Income = $50,000

- Social Security Income = $34,000

- RMD Amount = $18,000

RMD = Other Income

Right off the bat, you’ll notice that the scenarios in the case study begin to diverge with the “Other Income” category. That’s because the IRA owner who took their RMD from their IRA as income needs to include this as part of their adjusted gross income.

The IRA owner who didn’t take the RMD, but gave it straight to charity instead, reports $0 for “Other Income” (shown in the middle column, for a lower AGI figure of $18,000.

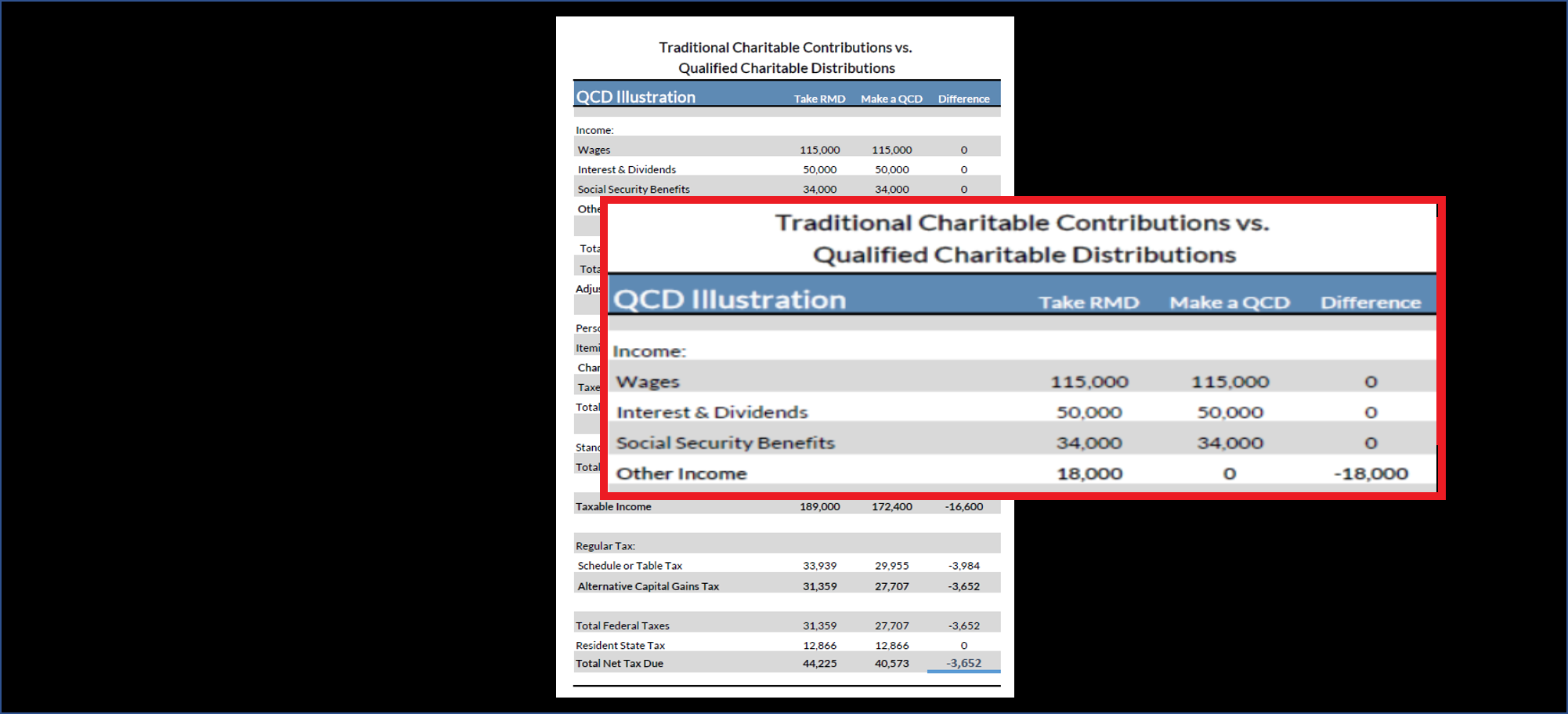

Adjusted Gross Income

Total Adjusted Gross Income (AGI) is $217,000 (see below) for the IRA investor who took out their RMD. AGI for the IRA investor who donated their RMD with the QCD strategy reported $199,000 of income for the year.

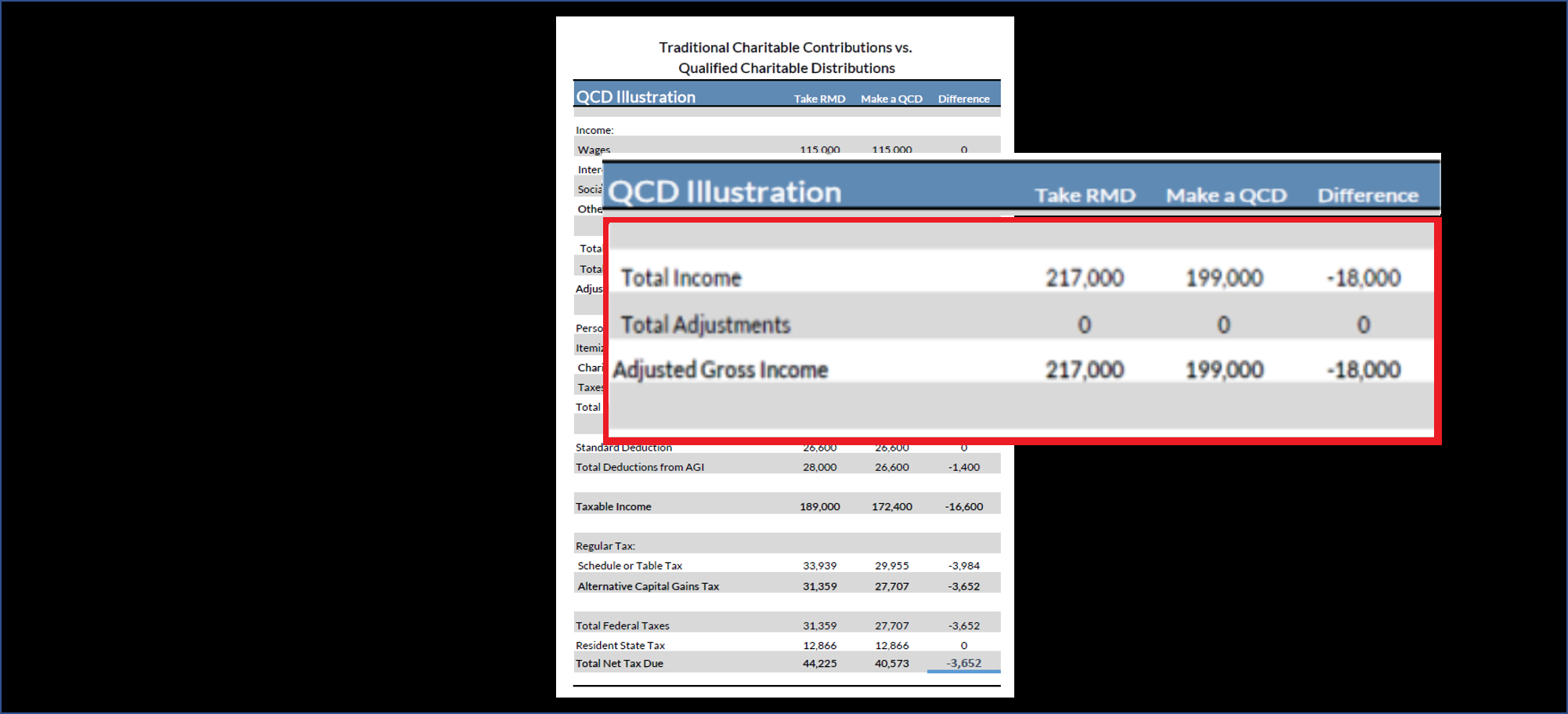

Charitable Contributions & Itemized Deductions

If you take a look at the “Charitable Contributions” line item below, you’ll see that the IRA investor who took his RMD, still donated the same $18,000 to charity. But instead, he gets to report this donation as a “Charitable Contribution” on his tax return.

The IRA investor reports charitable contributions as $0 since her $18,000 in contributions came directly from her IRA.

In addition, the total itemized deductions are also vastly different, since the IRA investor who made the QCD (middle column), only has $10,000 in total itemized deductions. This is because there were no “Charitable Contributions” reported.

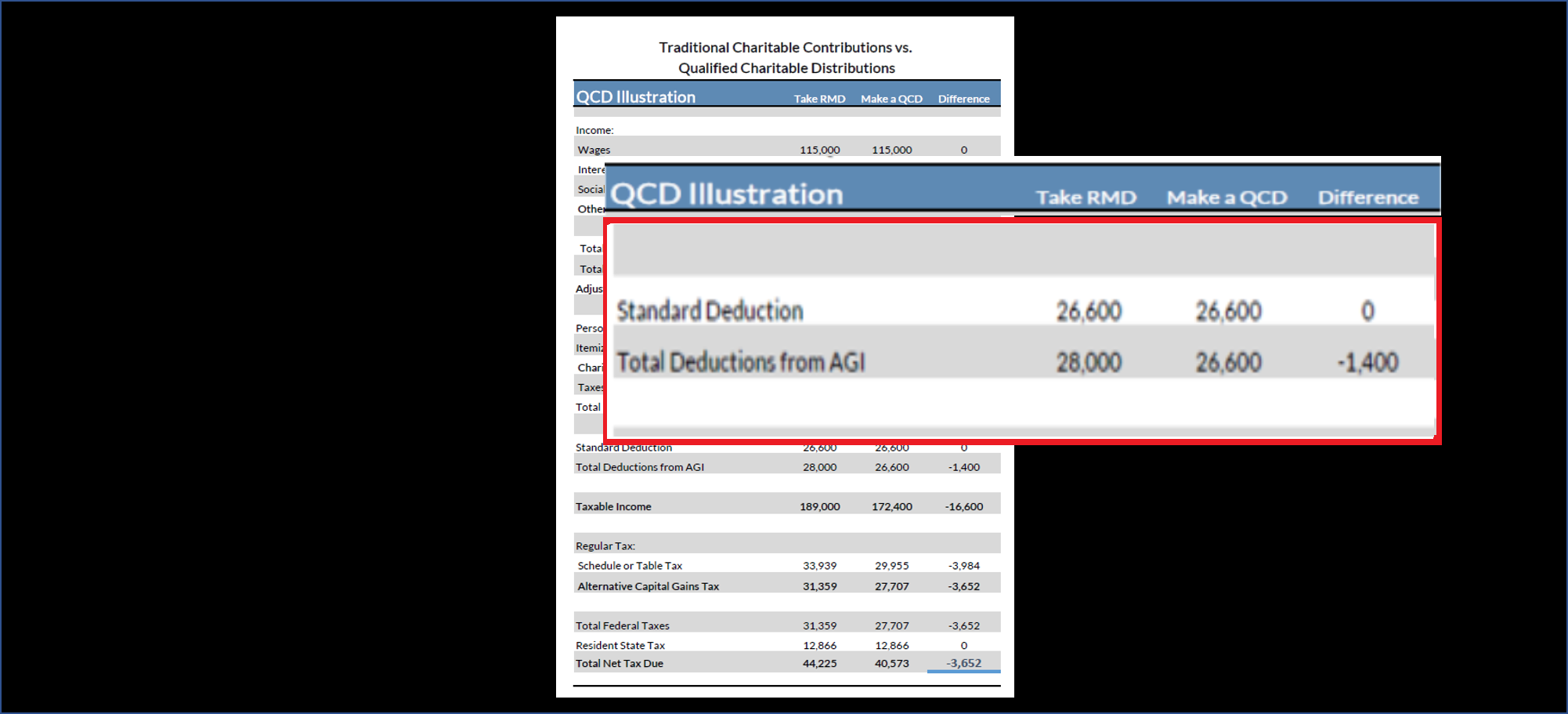

Total Deductions

The IRA investor who took his RMD as income and wrote checks to charity for $18,000, has a total of $28,000 in deductions, which is higher than the standard deduction of $26,600 for 2018. He will itemize because his deductions are higher than the standard deduction amount.

In contrast, the IRA investor who donated her RMDs directly to charity via the QCD method, will take the standard deduction of $26,600, since her total itemized deductions didn’t exceed the standard amount. Her deductions were only $10,000 for the year.

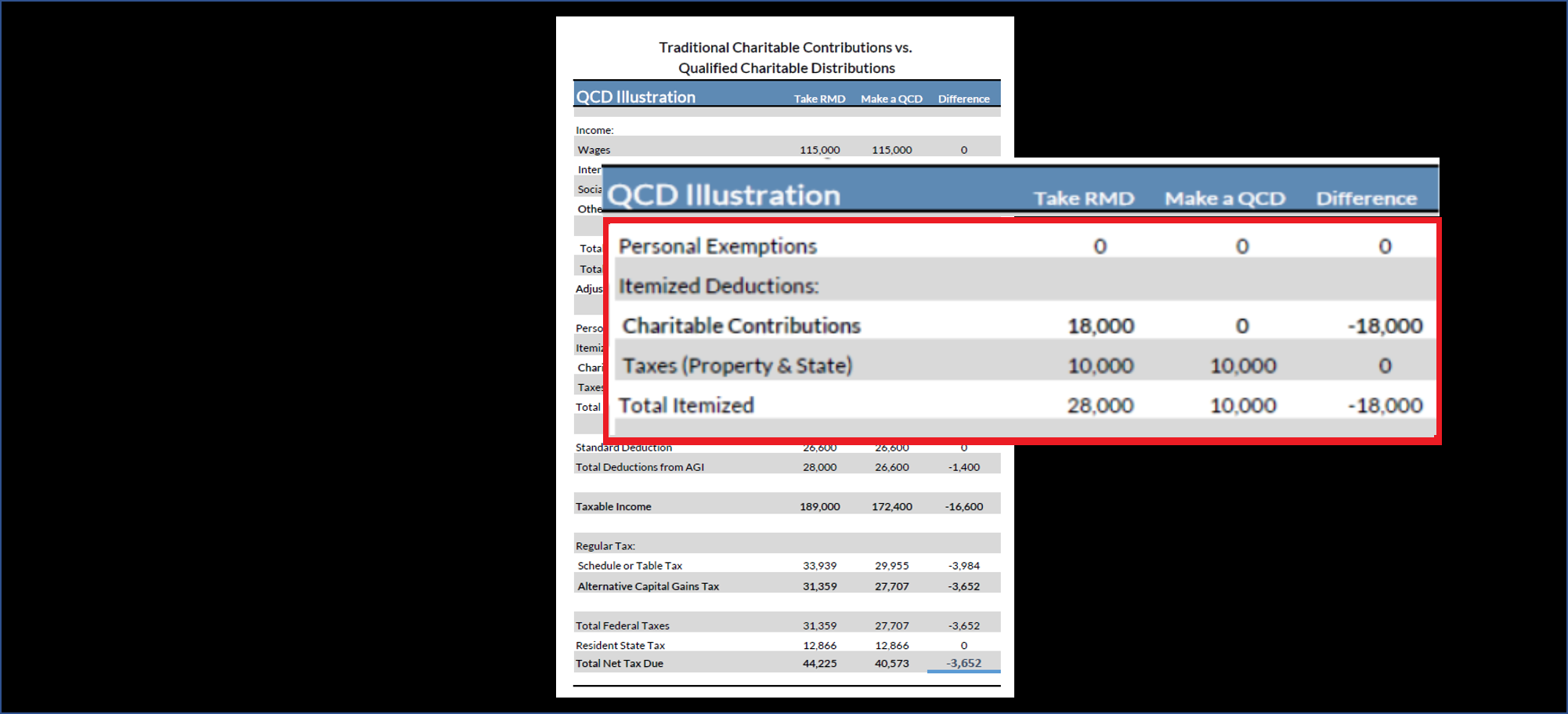

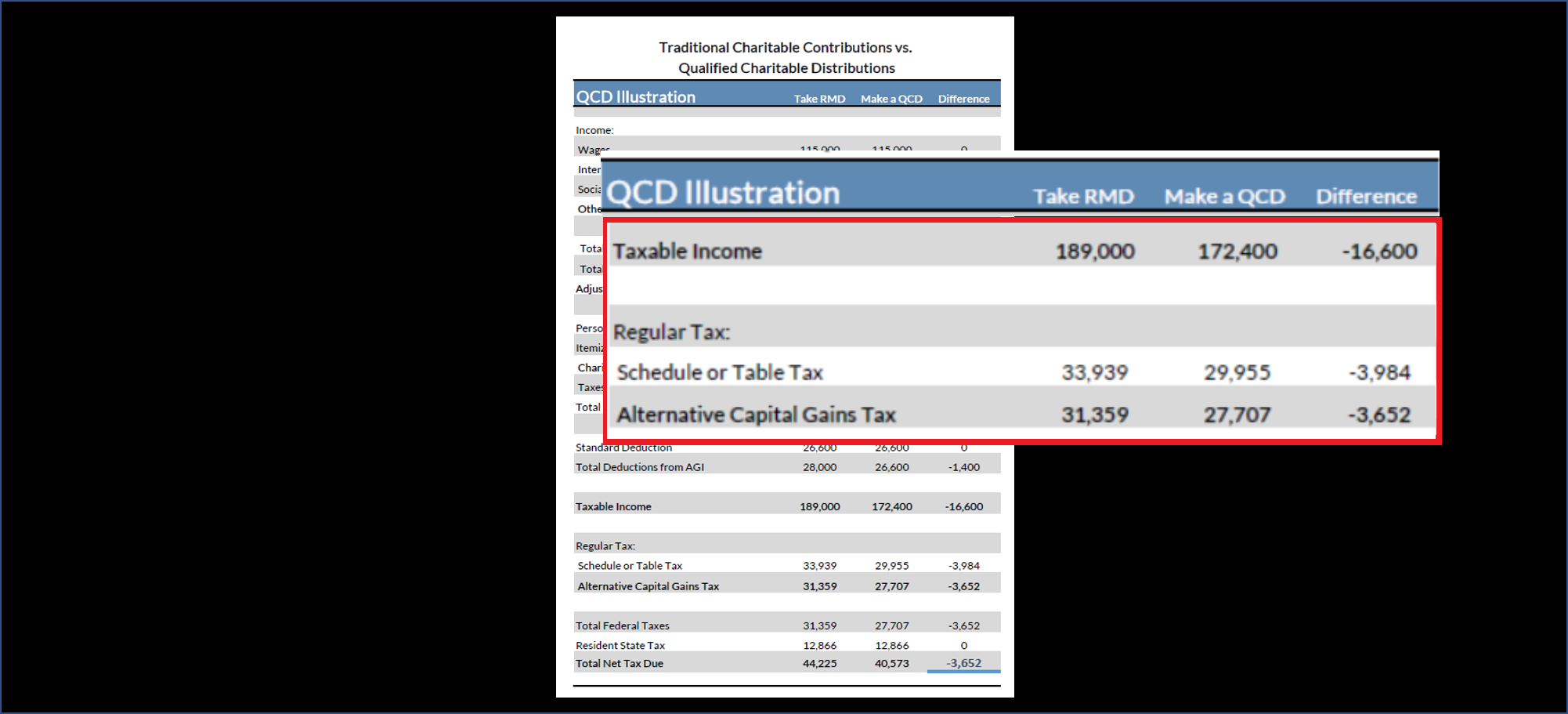

Taxable Income

The IRA investor who took their RMD and wrote checks to charity, had a taxable income that was $16,600 higher than the investor who donated her RMDs directly to charity via a QCD.

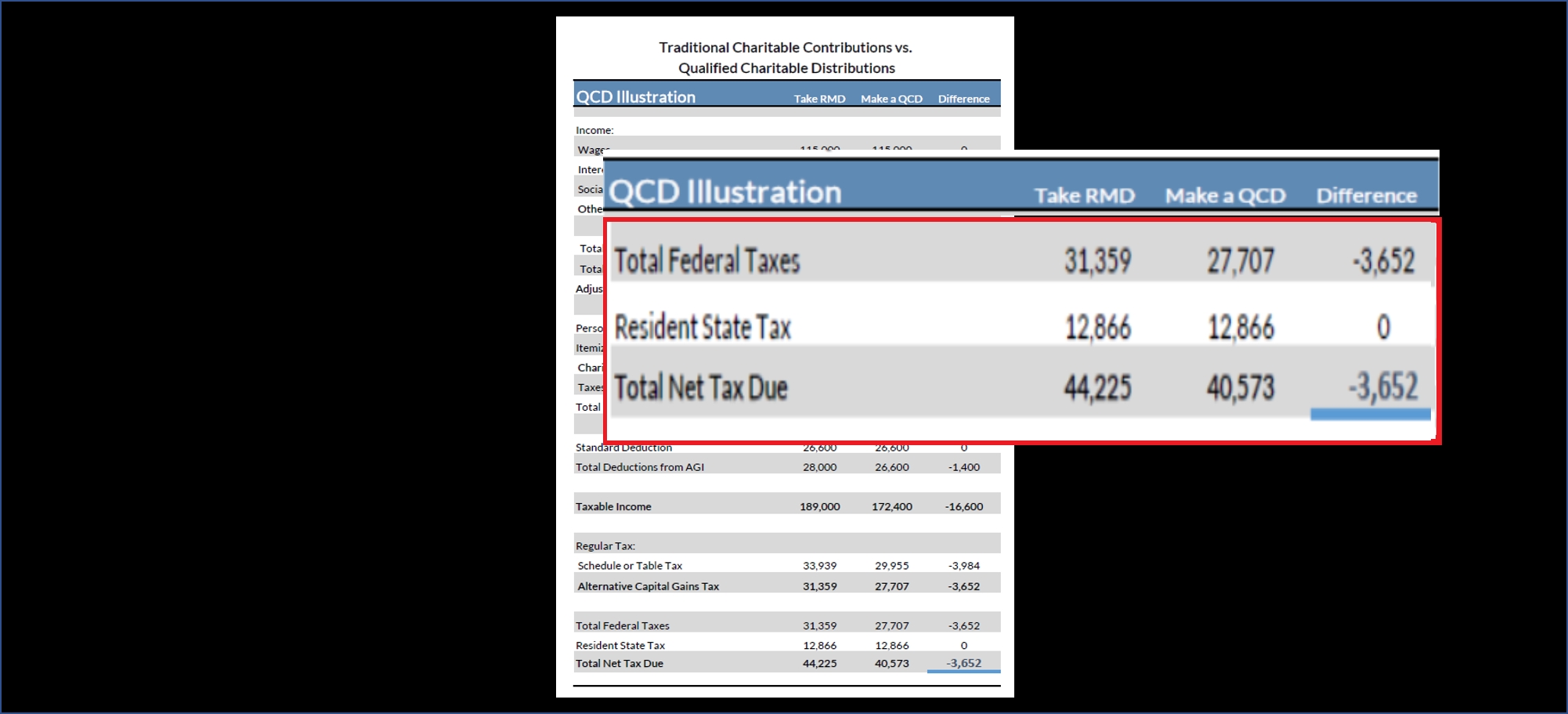

The Big Finale!

And as a result, the IRA investor who donated her RMDs directly to charity paid total taxes of $40,573, $3,652 less than the IRA investor who took his RMD!

>>> Tip: If you prefer to see and hear this case study explained, click here to watch the video!

Does a QCD Make Sense For You?

Like most investment and tax strategies, there is no blanket “this-works-for-everyone” right answer. Therefore, it is important to run the numbers for yourself to see if this strategy makes sense for you. If you work with a professional tax advisor, ask them to run a comparison like the one used here.

Fortunately, I’m married to a brilliant CPA, so he provided this case study for me in just a few minutes using his tax software…I always knew that when we started dating back in 2003, one day, he would be able to provide me with a much needed side-by-side tax projection so I could better illustrate my point in this blog post.

If you haven’t already taken your RMD this year, you still have time to make a QCD instead – so don’t wait!

What If You Need The Income From Your IRA?

You may be hesitant to donate your RMDs to charity because you’re actually using your RMDs for income. But if you have taxable investment accounts, it might make sense to take income from non-IRA accounts instead.

Since you only pay taxes on the gains from taxable accounts (not the total amount you withdraw), and taxes on capital gains are lower for many taxpayers compared to income taxes, it might be a wise strategy to withdraw a higher amount from your taxable accounts, and take a lower withdrawal amount from your IRA.

Also, keep in mind that this isn’t an all-or-nothing strategy. You could still withdraw your RMD like you normally do for a portion of your required distribution, and also contribute a portion to charity through the QCD strategy.