Click here to watch the full video >>

We love, love, love stocks and we wholeheartedly believe that it’s necessary to invest in the stock market if you’re serious about building long-term wealth.

But there are definitely certain situations when you shouldn’t put money in stocks.

And it has absolutely nothing to do with the economy, what’s going on in the world, or anything external like that. It has everything to do with WHEN you need the money.

So today, we’re going to talk about the one time you shouldn’t invest in stocks – which is when you’re saving for a major purchase that’s going to occur in the next few years…and what you should do with your money instead.

Case Study

I have a client who is very clear on his #1 financial goal for the next 5 years: buy a building/office space for his business. This is a TOP, TOP priority for this client and he plans to move his business and employees into this space when their lease is up in a couple years.

This property will continue to be an integral part of his retirement plan through retirement because he plans to hang on to it for the long-haul and collect rental income on the property after he retires.

The problem is that he is very specific about the location and size of the property he is looking for and he needs to be ready to jump on something at any time. So if he finds the perfect match next month or in 3-5 years, he needs to be ready with the down payment capital, which is going to be about $200,000.

Don’t Risk It!

The problem, though, is that because this purchase isn’t imminent, it’s not really appealing to park a couple hundred thousand dollars in cash at low (or worse – zero) interest rates.

And we definitely do not want to invest this capital into something that could drop in value…we can’t risk a 10, 20, or 30% loss by investing in the stock market, because if we have a recession and a bear market, that $200,000 down payment could drop by $50,000 or more, which could shatter his prospects of buying that coveted piece of property.

And if we have a recession, that could be the perfect time to find just the right property at just the right price!

But if he’s barely staying above water financially himself or worse, he no longer has the capital to take advantage of the opportunities that come during the hard times, he’s going to miss out – BIG TIME!

As the old saying goes “the time to buy is when there’s blood in the streets.”

Say no to stocks…and cash!

Whether you are setting aside $200,000 for a commercial property, or $20,000 for your daughter’s wedding next year, the advice holds true – you should sacrifice results in the short-term to ensure that your capital will be there when you need it if you have a major, planned purchase within the next 5 years.

It’s better to earn less on your capital than to take a bath if the stock or bond markets go south. And for heaven’s sake, please don’t even consider anything speculative like gold or bitcoin!

But you don’t have to stick it all under your mattress either, earning 0% interest. So what should you do instead?

You shouldn’t put it in the stock market, and you even need to be careful about investing in good old reliable bonds because you can lose money there too, especially if interest rates head higher.

And if you’re going to be saving this money for longer than about 10 minutes, you’re probably not going to want to stick it under your mattress or leave it in cash, where you will actually lose money because of inflation.

The Solution

Ugh, it sounds so boring, but it works, so here it goes – a bond ladder.

- Step 1: Decide how much you need

- Step 2: Make an educated guess about when you will need the funds

Going back to our previous example, my client needs about $200,000 and our best guess is that he’ll need this money in about 3 years.

Now we build the ladder: $200,000 into a 3-year bond ladder.

You could invest in corporate bonds or CDs. If you’re in a high tax bracket (especially in a high tax state like we are here in Oregon) tax-free municipal bonds are also a great option.

If you invest in corporate or municipal bonds, just stick with investment grade and make sure your holdings are diversified across several different bonds to minimize default risk.

CDs give you more piece of mind, since they are FDIC insured and, but the rate of interest rate you’ll earn is usually lower.

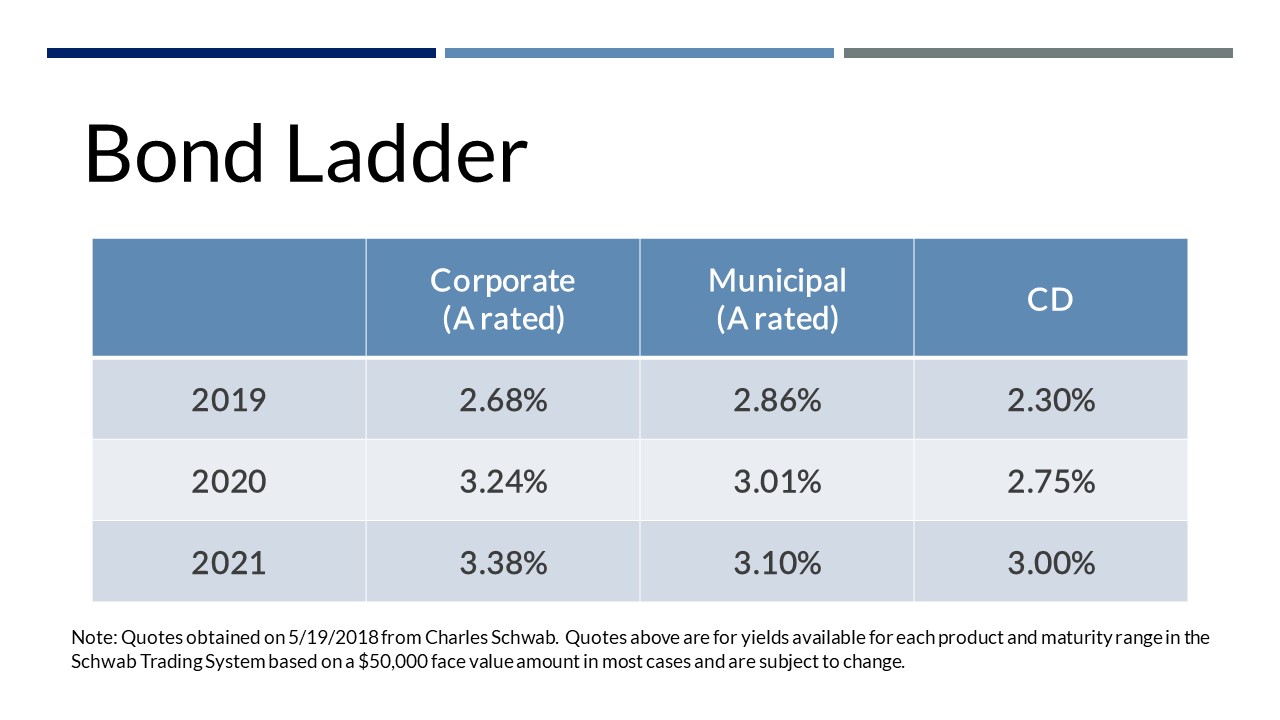

Let’s take a look at what the ladder would look like based on current rates (as of 5/19/2018):

If the major purchase date extends beyond 3 years, that’s even better because you can extend the ladder and potentially earn a higher interest rate on the reinvested bond, because the farther out you go on the bond maturity date, the more interest you can earn. But it’s important to match the timeline of your purchase with the timeline of the laddered portfolio.

After year 1, that first rung on the ladder will cash out and you will need to make a decision on what to do with the funds. You could extend the ladder another year if your timeline moves out past your original plan, keep it more liquid if the timeline has moved up, or re-invest in other bonds within the window of when you need those funds.

The beauty of the ladder is that by keeping it short-term, the penalties and potential losses are minimized if your plans change and you need to sell the bonds early.

What are your major, planned purchases within the next 5 years?

Take stock of major purchases you have planned within the next 5 years. Maybe it’s an acquisition or a new building for your business. Maybe it’s a piece of property to build your dream home, an RV, a wedding, or a second home so you can escape the rainy Pacific NW for a few months out of the year.

Whatever that big goal of yours is, it’s important to put that capital to work for you, but to do it in a way that preserves your capital for when you need it most.