Do you have rising dividend stocks in your portfolio?

Full Video Transcript:

“This is going to be one of the few ways that you’re going to get an increase in income stream in your retirement years.

I’m David Wilson, Founder and President of True North Retirement Advisors, where we do comprehensive retirement planning for business owners.

Do you have rising dividend stocks in your portfolio? An important way of growing your income in retirement is investing in companies that year in and year out, are growing their dividends 8% to 12% a year.

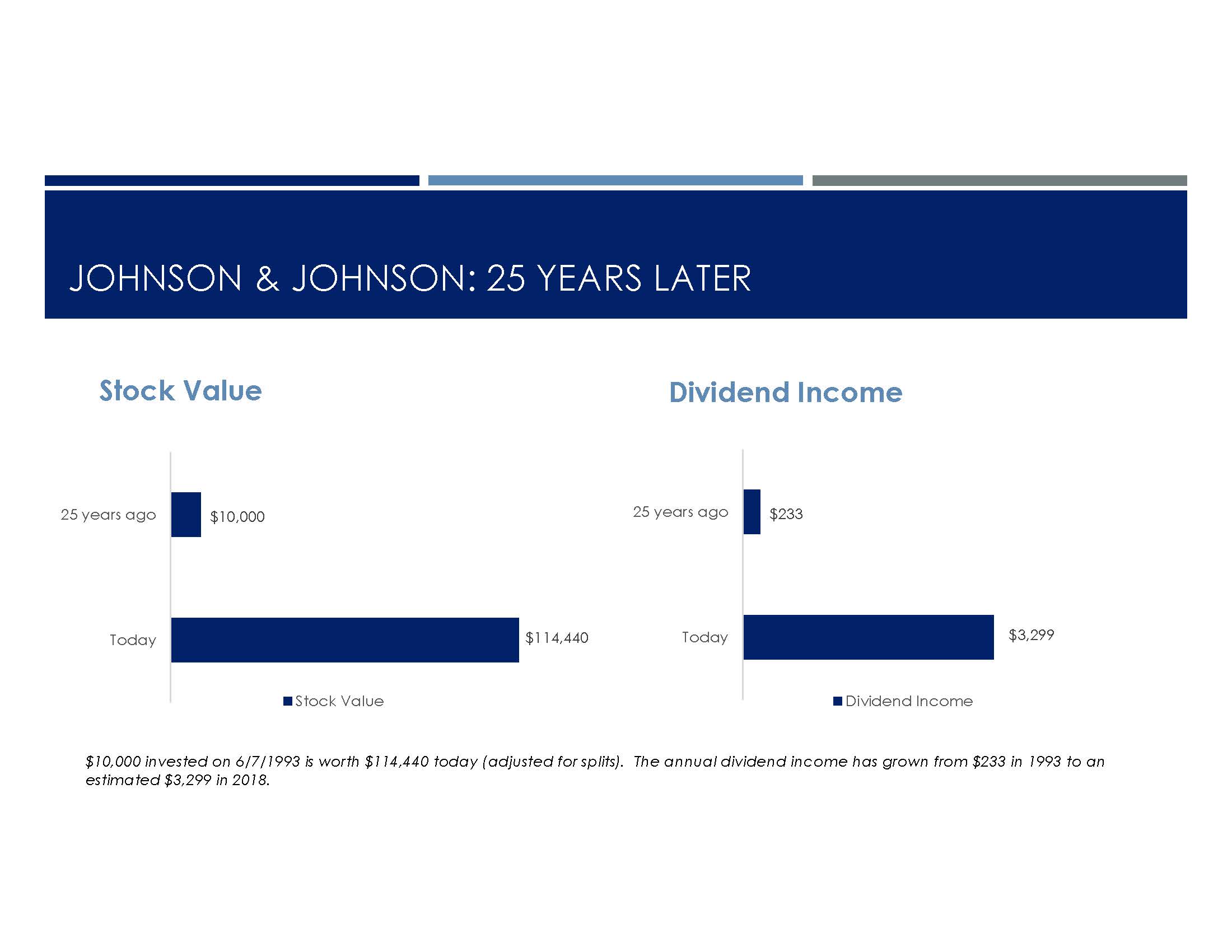

A Rising Dividend Star – Johnson & Johnson

A rising dividend stock that I wanted to share with you is a company called Johnson & Johnson. It’s paid increasing dividends for over 50 years. About 25 years ago when my dad was alive, I bought it for him for $10.88. This past year it hit a high of $146, so you can see right there over a 25-year period we had over 12 or 13-fold increase in the value.

So you’d say, “Yeah, that’s pretty good,” and it is. I mean it’s outstanding, and believe me, Johnson & Johnson is like watching paint dry, it’s that boring of a stock.

But over time, that’s how you create wealth. The other key aspect is the growing stream of income that they’ve thrown off. Again, they’ve thrown off consistently 7% to 8% dividend growth a year.

My mom got the stock after my dad passed. After my mom passed, my brother and I currently own the stock, and we are getting a 30%

annual return just from the dividend, on my dad’s original investment.

*Please note: I own Johnson & Johnson this example is for illustration only and this is not a recommendation to buy Johnson & Johnson stock.

So not only can you increase wealth by owning rising dividends stocks, you can also get a growing stream of income over many many years.

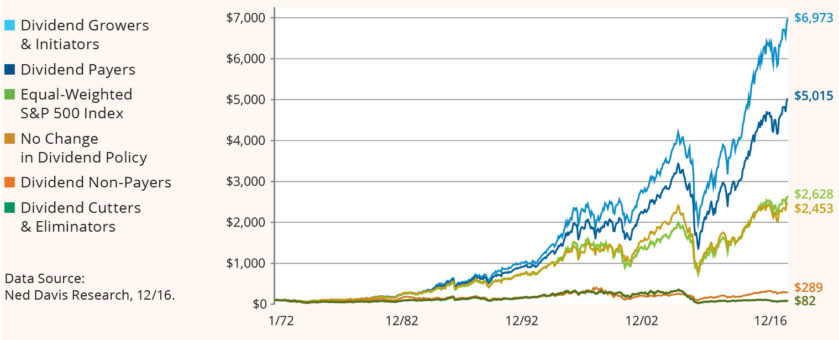

Back in 2014, Ned Davis Research did an analysis of companies that grew their dividends, companies that paid a dividend, companies that cut their dividends. What they found is that companies that consistently grow their dividends provide a better total return than all other stocks.

The Ned Davis Research study was actually over a 44-year period from 1972 through 2016. Over that period, companies that consistently grew their dividends provided the best total return, 10.1%.

Dividends are underrated

Dividends are one of the most underrated aspects of stock ownership. The reason for that is that it’s something that is not very sexy, & it doesn’t get a lot of play by the media. You have to look in special places in the paper just to find what the dividends are. But over the last 80 years, dividends have accounted for over 40% of the total return of stocks

Don’t Make This Mistake When You Buy Dividend Stocks

When you look at dividend-paying stocks, you want to be careful not to pick high-dividend-paying stocks, because many of those companies, while they may yield 4% or 5% or even higher, typically do not provide a good total return. In fact, in many cases, they are even apt to cut their dividend.

The Sustainable Dividend Formula

What you want to own are companies that pay dividends of between 2% and 3% a year, but are growing those dividends 8% to 12% annually.

Take Action

So if you’re approaching retirement or you are already in retirement, you want to have rising dividend stocks as a key component of your portfolio. Take a look at your portfolio to see if it is providing the kind of income stream that’s going to serve you in retirement, or if there are other assets that you have that you might be able to convert into rising dividend stocks.”